Washington expresses readiness to be more “flexible” with Iraq

Shafaq News/ Iraq and the United States concluded their meetings in Turkiye to follow up on the financial situation in Baghdad.

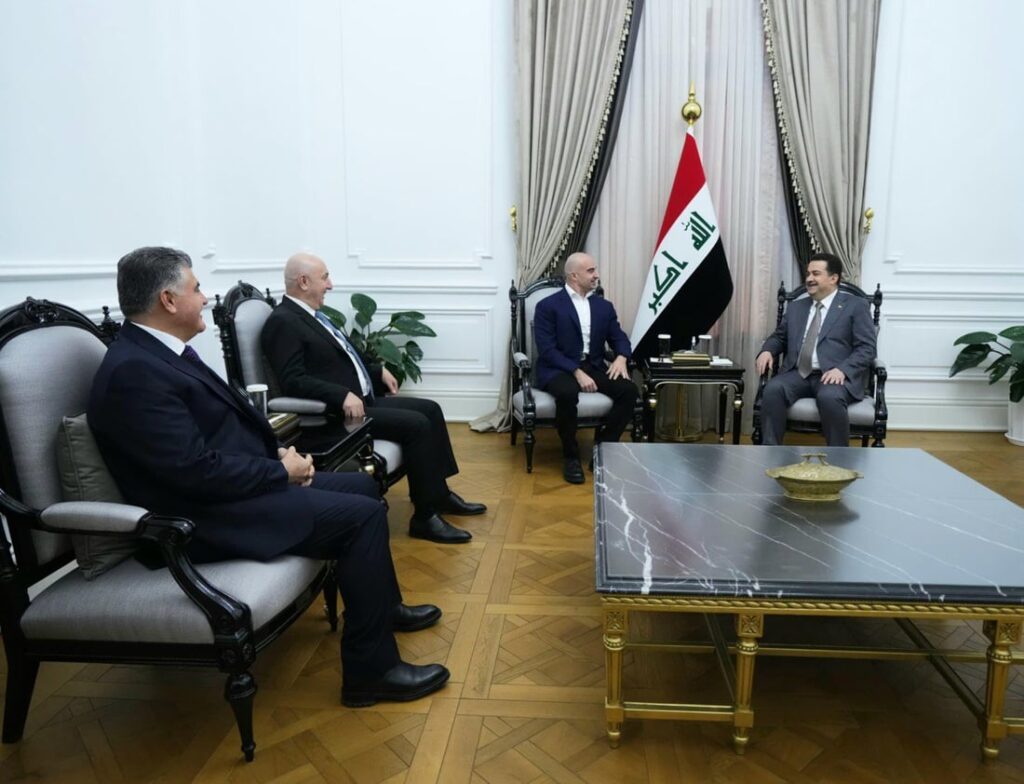

The Central Bank of Iraq (CBI) stated that governor Ali Mohsen Ismail and his accompanying delegation concluded their talks with a U.S. delegation headed by the Under Secretary of the Treasury for Terrorism and Financial Intelligence Brian E. Nelson.

Both sides discussed cooperation and coordination between Baghdad and Washington to “achieve exchange rate stability in Iraq.”

The U.S. Treasury expressed readiness to provide more “flexibility” for more economic stability in Iraq.

Both agreed to continue coordination and cooperation until the following meetings in Washington later this February.

It is worth mentioning that the United States has restricted Iraq’s access to its dollars, trying to stamp out what Iraqi officials describe as rampant money laundering that benefits Iran and Syria.

The exchange rate for the Iraqi dinar has jumped to around 1,750 to the dollar at street exchanges, compared to the official rate of 1,460 dinars to the dollar.

Since the 2003 invasion, Iraq’s foreign currency reserves have been housed at the United States Federal Reserve, giving the Americans significant control over Iraq’s supply of dollars. The Central Bank of Iraq requests dollars from the Fed and then sells them to commercial banks and exchange houses at the official exchange rate through a mechanism known as the “dollar auction.”

In the past, daily sales through the auction often exceeded $200 million per day.

Ostensibly, most of the dollars sold in the auction are meant to go to purchases of imported goods from Iraqi companies. Still, the system has long been porous and easily abused, multiple Iraqi banking and political officials told The Associated Press.

U.S. officials confirmed to the AP that they suspected the system was used for money laundering but declined to comment in detail on the allegations or the new restrictions.

For years, large quantities of dollars were transferred out of the country to Turkey, the United Arab Emirates, Jordan, and Lebanon through “gray market trading, using fake invoices for overpriced items,” a financial adviser to the Iraqi prime minister said to AP, speaking on condition of anonymity because he was not authorized to discuss the matter publicly.

He said that the inflated invoices were used to launder dollars, with most of them sent to Iran and Syria, which are under U.S. sanctions, leading to complaints from American officials.