Basra crudes ended lower on Friday to tally a weekly loss

Shafaq News/ After rallying at the start of the week, oil prices had offset their gains and ended the week with another loss as U.S. inventory data and rising doubts about the speed of China's economic recovery shift sentiment.

The volatile session reflected investor concerns that interest rates would continue to rise following a strong US jobs report.

Investors also focused on the embargo on Russian refined products agreed upon by the EU, G7 and Australia on Friday, as well as signs that an economic recovery is underway in top crude importer China.

Brent, the benchmark for two thirds of the world’s oil, fell $2.23, or 2.71 per cent, to $79.94 a barrel at the close of trading on Friday. West Texas Intermediate, the gauge that tracks US crude, lost $2.49 to settle 3.28 per cent lower at $73.39 a barrel.

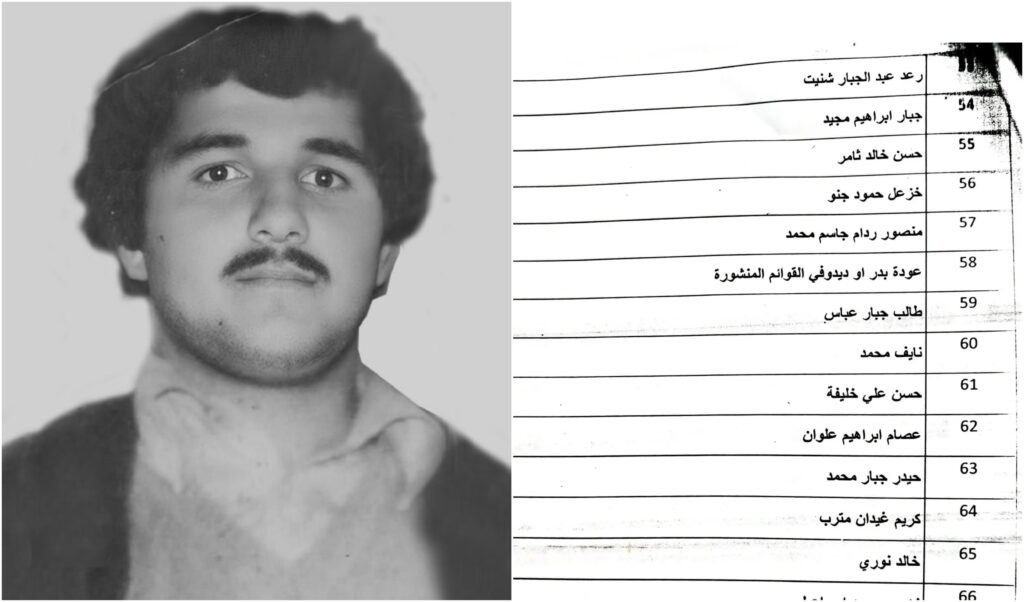

Basra's heavy crude settled $0.85 lower to $72.24 on Friday, extending a weekly loss of $5.02, or 6.5%. Also losing $0.85, the light counterpart settled at $77.79, down nearly 6.06% on the week.

After this week's price decline, investors will focus on the extent of a demand recovery by China as well as the impact of a European Union embargo on imports of Russian fuel products due to take effect on Feb. 5 and an anticipated deal on price caps will play out.

US employers added far more jobs than forecast last month, underlining the resilience of the labour market despite aggressive actions from the Federal Reserve to cool inflation.

Total non-farm payrolls added 517,000 jobs in January, data from the Labour Department showed, far exceeding a Reuters estimation of 185,000. It also surpassed the number of jobs added in January 2022 by 13,000.

Meanwhile, the EU, G7 and Australia on Friday said they agreed on price caps for Russian petroleum exports, aimed limiting the ability of Russian President Vladimir Putin to fund his military offensive in Ukraine.

The caps include $100 per barrel on expensive fuel like diesel and $45 on other products such as fuel oil, officials said.

Optimism over China’s reopening had pushed oil prices close to $90 a barrel last month. However, rising economic uncertainty and concerns of weakening demand have since weighed on futures.

The US Dollar Index, a measure of the value of the greenback against a weighted basket of major currencies, was up 0.12 per cent at 101.87.

A stronger dollar makes oil more expensive for holders of other currencies.

Central banks around the world have raised their benchmark borrowing rates after the US Federal Reserve raised interest rates by 25 basis points in its first policy decision of the year on Wednesday.

This was the eighth rate increase and the smallest in the federal funds target rate range since the US central bank began to raise rates last year in March.

It also pushes interest rates in the US to their highest point since the 2008 financial crisis. The Fed further indicated that more increases were to come.

The Bank of England has also raised interest rates by 0.5 per cent to 4 per cent as it looks to rein in high inflation in the UK.

UK interest rates are now at their highest levels since late 2008 and a BoE statement warned that further tightening of rates was possible.

The European Central Bank also increased interest rates by 0.5 per cent.

In a surprise move, the Central Bank of Egypt kept interest rates steady at its first meeting of the year on Thursday, despite soaring inflation.

The bank’s monetary policy committee kept its overnight deposit rate, overnight lending rate and the rate of the main operation at 16.25 per cent, 17.25 per cent and 16.75 per cent, respectively.

Last week, the IMF marginally raised its growth forecast for 2023 on easing inflation, China's reopening and resilience in the global economy.

It raised its global economic growth estimate for this year to 2.9 per cent from a previous forecast of 2.7 per cent and said that more work needed to be done for full recovery to take place.

On Wednesday, the Opec+ alliance of 23 oil-producing countries agreed to roll over its existing oil output cuts of 2 million barrels per day amid an improving fuel demand outlook in China.